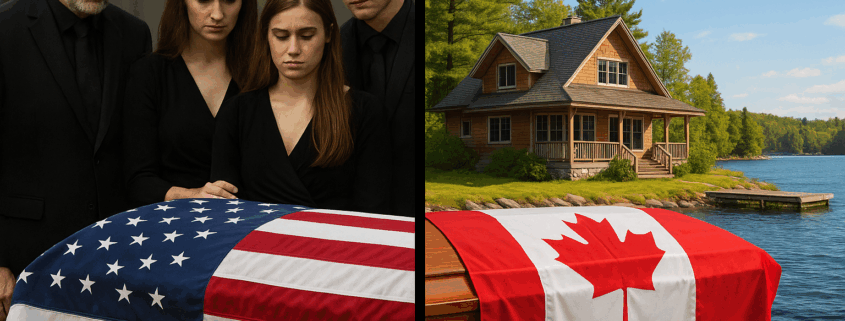

When a loved one dies with Ontario real estate but probate was completed in the U.S.

When a loved one passes away owning property in Ontario, but their Will is probated in a U.S. state such as Florida, you might assume that the U.S. probate documents will be enough to handle the sale or transfer of the Ontario property. Unfortunately, that’s not the case.

Ontario law requires a separate Ontario court grant before you can deal with Ontario real estate. Without it, the Ontario Land Titles Office and the buyer’s real estate lawyer will not accept your authority to sell the property.

In this post, we explain why U.S. probate isn’t enough, what Ontario requires, how this differs from “resealing,” what probate tax (Estate Administration Tax) you’ll pay, and how to avoid common mistakes—complete with a real-world example.

Resealing vs. Ancillary Probate in Ontario

Ontario recognizes two different paths for foreign probate grants:

1. Resealing

- Used when the original grant is from another Canadian province/territory, the U.K., or another Commonwealth jurisdiction.

- Ontario simply “reseals” the foreign grant so it is effective here—no need to repeat the probate process.

2. Ancillary Appointment (With Will)

- Required for non-Commonwealth grants, such as those from U.S. courts.

- Ontario issues a Certificate of Ancillary Appointment of Estate Trustee With a Will (Form 74.29).

- The application relies on court-certified copies of the foreign probate grant and the Will, along with Ontario-specific requirements like probate tax and estate asset disclosure.

If you’re dealing with a U.S. probate, you’ll almost always need an Ancillary Appointment before taking any steps to sell or transfer Ontario property.

What You Must File in Ontario

To obtain an Ontario Certificate of Ancillary Appointment, you must file:

- Application for Certificate of Ancillary Appointment (With Will) under Rule 74.

- Court-certified copies of the U.S. grant and the Will.

- Certified proof of death (e.g., death certificate).

- Ontario estate value statement and payment of Estate Administration Tax (EAT).

Note on bonds: If the executor is non-resident, the court may require an administration bond unless you apply to have it dispensed with. This is best addressed early to avoid delays.

Ontario’s Estate Administration Tax (“Probate Tax”)

Ontario charges Estate Administration Tax (EAT) based on the value of Ontario assets:

- $0 on the first $50,000 of estate value.

- $15 per $1,000 (1.5%) on the value over $50,000.

When filing an ancillary application, EAT is calculated only on Ontario-based assets (you do not pay Ontario tax on non-Ontario assets).

Real-World Example: Florida Probate → Ontario Property

Scenario: Janet probated her mother’s Will in Florida. Her mother owned a cottage in Ontario. Janet asked whether the Florida grant could be used to sell the Ontario property.

Answer: Ontario does not accept U.S. probate orders. Janet must apply for an Ontario Certificate of Ancillary Appointment (With Will). She will need:

- Court-certified copies of the Florida grant and Will.

- Certified death certificate.

- Ontario property details (legal description, PIN, municipal address, and value for EAT).

- Bond considerations if she, as executor, is non-resident.

Outcome: With the Ontario ancillary certificate, Janet can confidently list and sell the Ontario property. The Land Titles Office and the purchaser’s real estate lawyer, as well as her real estate lawyer will recognize her authority to sell the property.

Common Pitfalls (and How to Avoid Them)

- Sending the original Will out of the U.S. court file: Ontario accepts court-certified copies—never risk losing the original.

- Using the wrong process: U.S. grants require ancillary probate, not resealing.

- Ignoring Ontario probate tax: Budget and pay EAT upfront to avoid delays.

- Bond surprises: If you are a non-resident executor, identify the bond requirement early and, if appropriate, have your lawyer apply to dispense with it.

How Rabideau Law Can Help

At Rabideau Law, we regularly assist U.S. executors with Ontario estates. Our services include:

- Strategic guidance on the right process (reseal vs. ancillary).

- Preparation and filing of all Ontario court documents.

- Bond relief applications to save you the cost and hassle of security.

- Virtual real estate closings, so you can sell the property without ever travelling to Canada.

- End-to-end management, from probate to closing, ensuring you meet Ontario’s legal requirements quickly and efficiently.

If you’re a U.S. executor facing Ontario property issues, contact Rabideau Law today—we make cross-border estate administration seamless.